Payroll Processing & Recording

Accurate payroll entries for clean books, compliant reporting, and true labor cost visibility

What This Service Includes:

Employee & Contractor Payroll Processing

Accurate Payroll Journal Entries in QuickBooks

Deductions, Benefits & Accruals Tracking

Payroll Liability Reconciliation

Why Payroll Processing & Recording Matters

Proper payroll management helps you:

Monthly Deliverables

$ Pricing

Starting at $50/month

🕒 Who This Service Is Ideal For

Your success in QuickBooks is our priority.

We stand behind our work with a 100% satisfaction guarantee — if something isn’t set up correctly or as promised, we’ll fix it at no additional cost.

Your payroll will be:

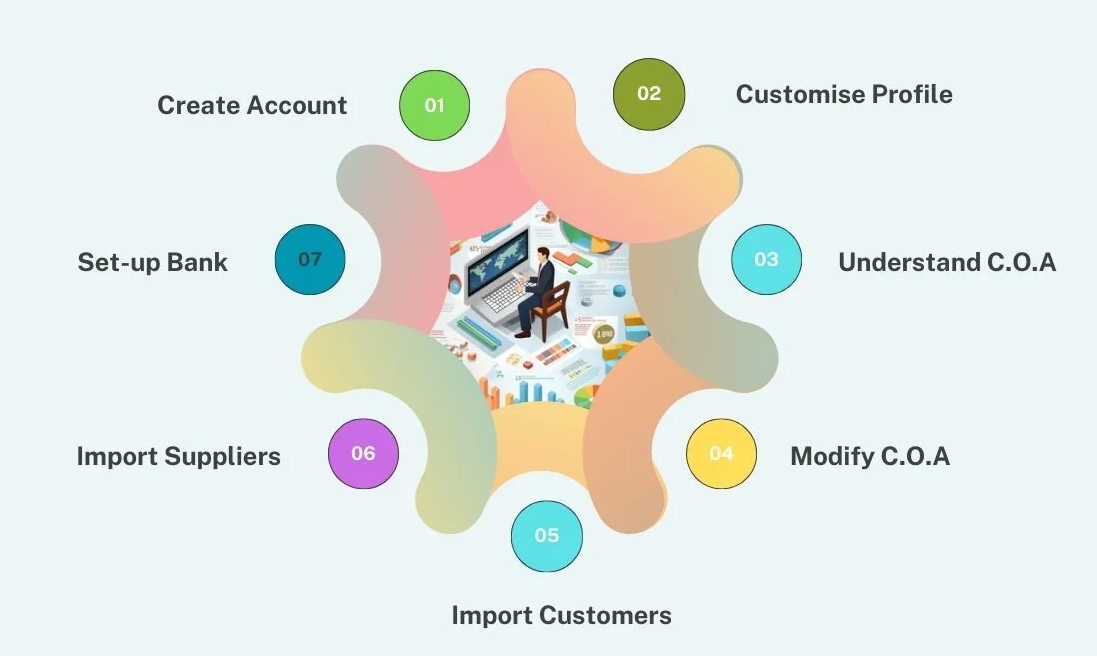

How Payroll Processing Works

Why Businesses Choose Us

We specialize in professional QuickBooks setup and customization for small and growing businesses. As a Certified QuickBooks ProAdvisor, we combine technical expertise with real-world bookkeeping experience to deliver a QuickBooks file that’s accurate, organized, and built for your business goals.

A QuickBooks system that saves time, improves reporting accuracy, and gives you confidence in your financials.

Testimonial

Let’s review your payroll process, employee/contractor structure, and recording needs — and create a tailored payroll management plan for your business.

30-Minute Meeting with a Certified QuickBooks Expert & Accountant

In your consultation, we’ll cover:

- ✅ Your payroll frequency & workflow

- ✅Employee and contractor setup

- ✅ Required journal entries & QuickBooks mapping

- ✅ Payroll liabilities, deductions, and benefits

- ✅ A customized monthly payroll estimate

Both. We run payroll for your employees/contractors and record every payroll cycle in QuickBooks accurately.

We support QuickBooks Payroll, Gusto, ADP, Paychex, Rippling, Patriot, and most third-party providers.

Yes — PTO accruals, health insurance deductions, retirement contributions, and benefits are fully tracked and updated monthly.

Your payroll platform handles the tax payments — I ensure they are properly recorded and reconciled inside QuickBooks.